Build A Tips About How To Become An Idaho Resident

New students enrolling at the college of law have numerous ways to qualify for residency.

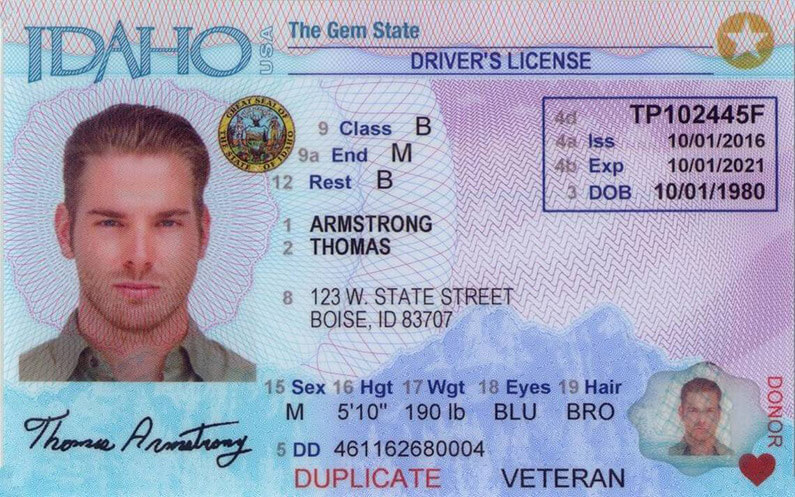

How to become an idaho resident. They also own a home in idaho where they vacation each summer. Your residency status determines what income the state of idaho can tax. Active duty military pay isn't taxed.

You may register at your polling place on election day by providing proof of residence. 2.if your domicile is another state, you're a military nonresident. Married to an idaho resident student is married to a person who is classified, or eligible for classification, as an idaho resident for the purposes of attending an idaho public institution.

Idaho has election day registration. This applies only if your idaho address is your principal. To qualify as a bona fide resident of idaho, you must establish domicile for an entire tax year and live there for no less than 270 days out of the.

1.if idaho is where you're domiciled, you're an idaho resident. Keep a home in idaho for the entire tax year and. You are dependent and your parent or guardian is in the armed forces or served for at least two years.

There are three residency statuses: Do i pay resident income taxes to the state of oregon? If your domicile is another state, you're a military nonresident.

Complete the idaho residency determination worksheet (irdw). Lawful presence in the u.s. That’s all it takes to support the journalism you rely on.