Casual Tips About How To Recover A Bounced Check

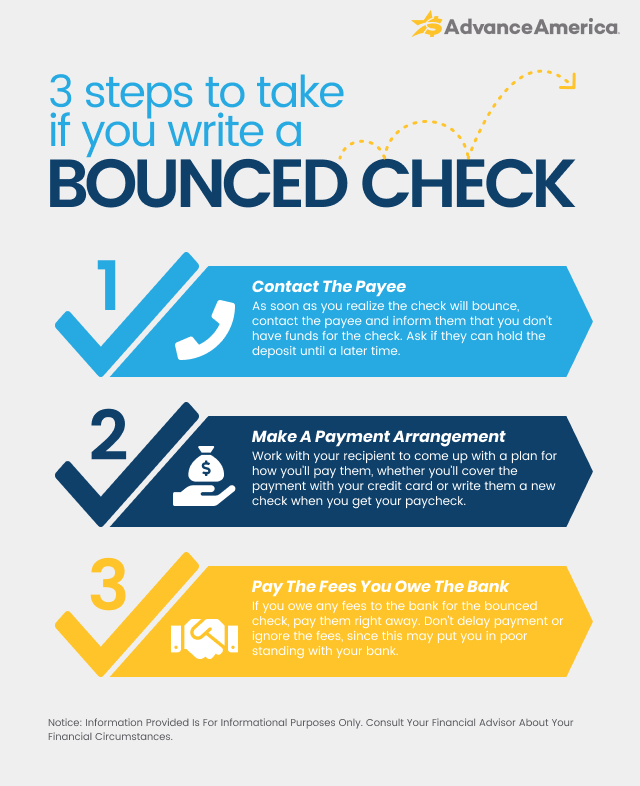

Steps to take when your check bounces.

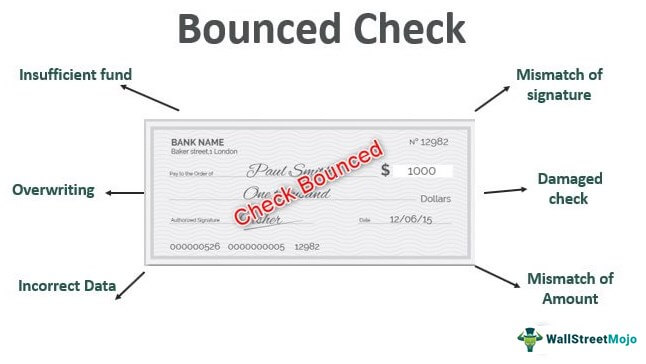

How to recover a bounced check. If this is your first time bouncing a check, your bank might be more lenient about. You may also recover damages equaling three times the amount of the check, up to a maximum of $1,500, if you meet certain conditions: In the received payment window, select and uncheck the box for the original invoice the bad check was attached to.

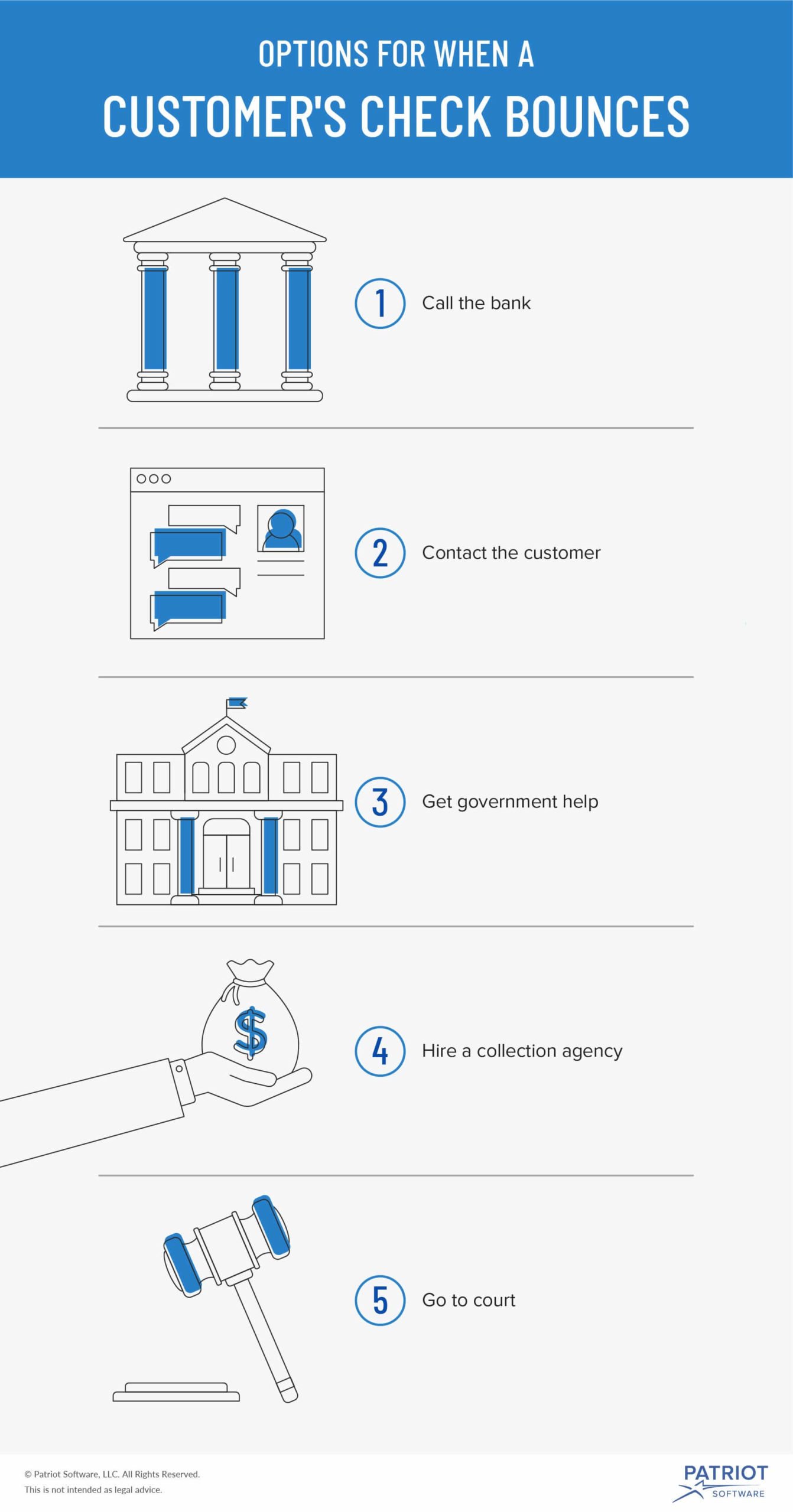

You can also go to a branch of the bank the check draws on and try to cash it. The money you need (if it exists) will be at the check writer's bank, not yours. Contact a new jersey debt collection law firm to help you recover a bounced check the legal team at snellings law llc uses every resource available to pursue your right to collect the debt.

Maybe the bounced cheque was just an accident and all you need to do is cover up for some insufficient funds. If you bounce a check, contact your bank and the person or company that received your check as soon as you're aware of the mistake. Cover the bounced amount as fast as you can.

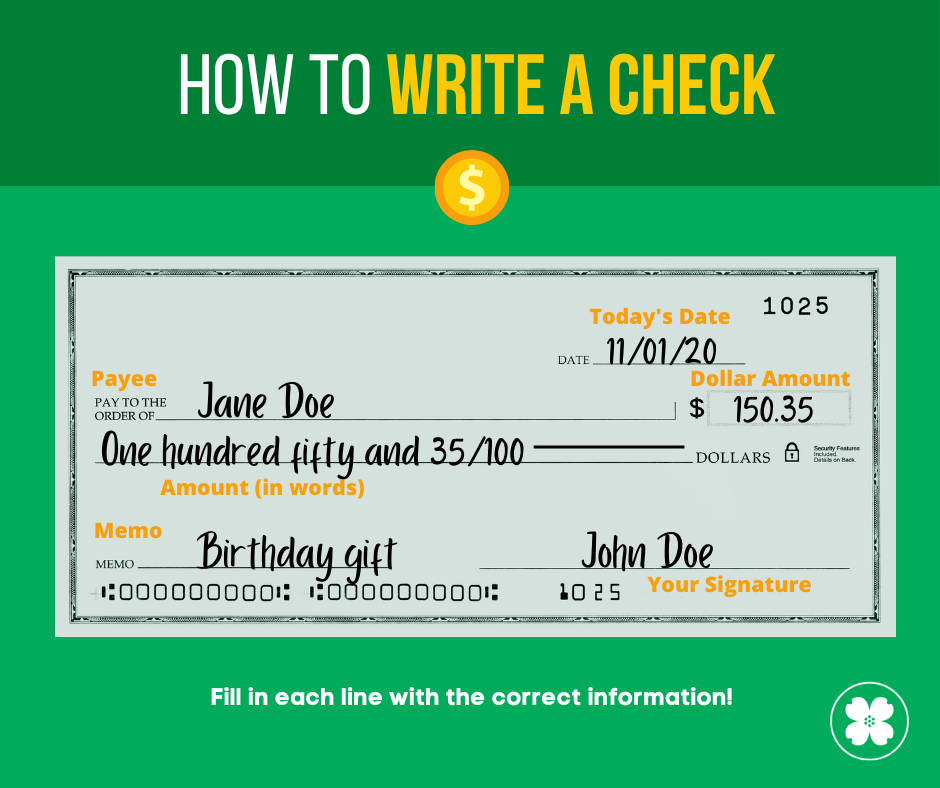

A customer writes a check in your store or service business. Find and select the record for the bounced check. Ask your bank if it can forgive your overdraft fee.

One, you’ll inform the customer of the situation. Tell them the check bounced and ask if they can make it good with a money order, cash or a. On the first line, select accounts receivable from the account menu.

Once you realize the check has bounced, you need to speak with your customer. If they aren’t a regular customer, use the phone number on the check, if it has one. This call serves two purposes.