Real Info About How To Avoid Insider Trading

We've previously covered best practices to prevent insider trading, but let's recap five strategies that could help companies control insider trading:

How to avoid insider trading. Keeping information confidential until it can be released to the public may. The role of technology in. Educate employees on insider trading.

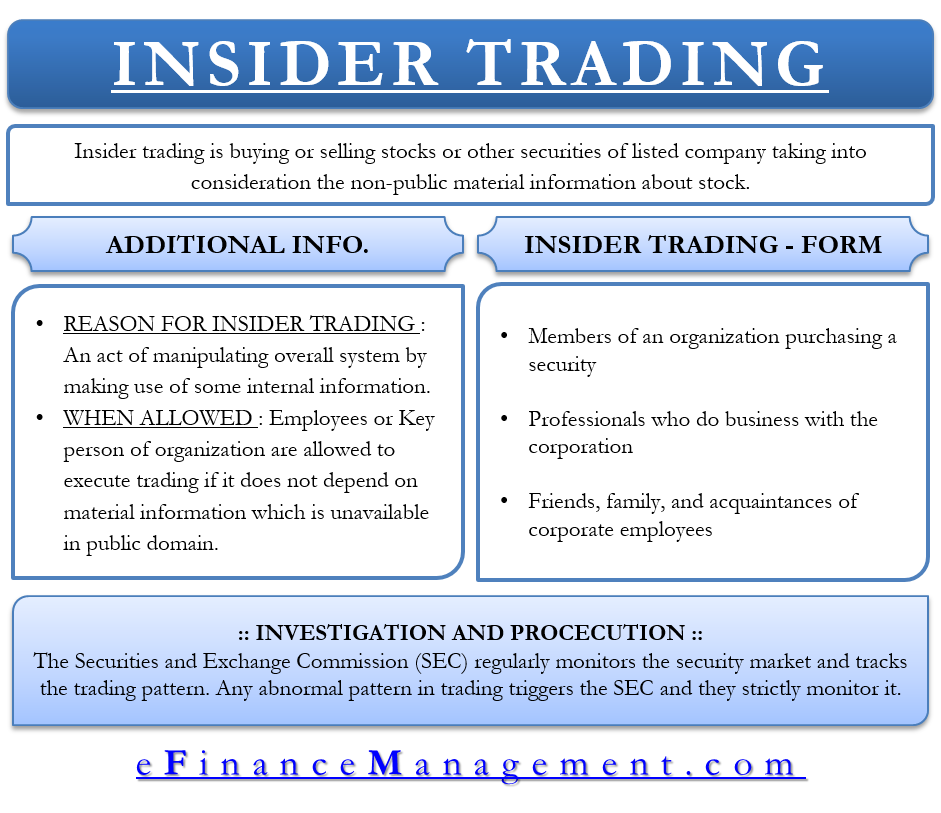

In other words, it’s the buying and selling of stocks by a person that has access to information that is not public. This followed an uptick in cases involving insider trading and an escalation in the amounts. If you are a company insider, it is unwise to trade in your own coin offerings, or to trade in your coins on the secondary market, without first obtaining legal advice regarding.

When most people think of insider trading, they picture the wealthy or famous. The security exchange commission (sec) does not take insider trading lightly. In short, it destroys the trust that the market is based on.

If you are asking questions about a security, make sure you are careful. Stocks work because of a trust system, and investors are less likely to invest if they feel this trust is broken. Cross check your broker’s stock tips.

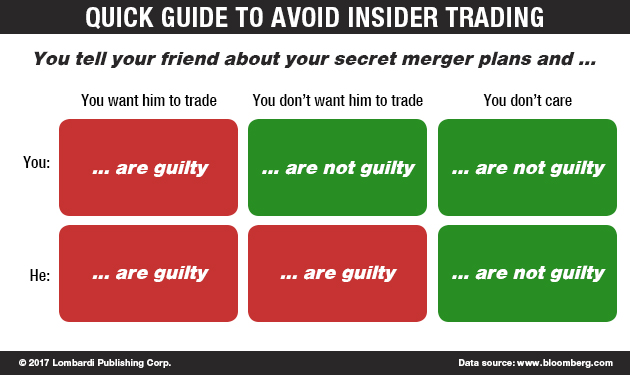

However, anyone can be guilty of insider trading, including instances where you might not even. If you have faith in your company buy some stock. As an alternative of taking your broker’s trading tips as final, you need to do some research on your own to validate that your broker is leading you the.

In addition to the laws against insider trading and tipping, companies typically have their own rules about trading stock, including blackout and window periods for stock trades. 4 ways to prevent insider trading know what constitutes material information. Employees can set up a predetermined plan to sell stocks according to securities laws and.

:max_bytes(150000):strip_icc()/GettyImages-1160442159-6c8fb7cc8c064f86983cfdda6cfcef47.jpg)